- 1 Submit Online

- 2 Fast Lender Approval

- 3 Cash in Your Account

Payday Loans for Bad Credit History Applicants

When we speak about “level of trust”, we often hear, “good credit” or “bad credit”. What does that mean? Your credit history is collected and processed by credit reporting agencies, compiling your credit report. If it contains positive information, it will report that you have good credit. If there’s a lot of negative information, such as defaulted loans, late payments, etc., you might be considered a “poor risk”.

Bad credit can affect your chances to get approved for a loan, find a good job, buy a car or rent an apartment. That’s why you need to understand how credit reporting companies measure your credit score. A credit score is the number that lenders use to quantify how risky a borrower you are. It’s used by banks and credit card companies to determine if you are a good or poor risk for lending.

What influences a Credit Score?

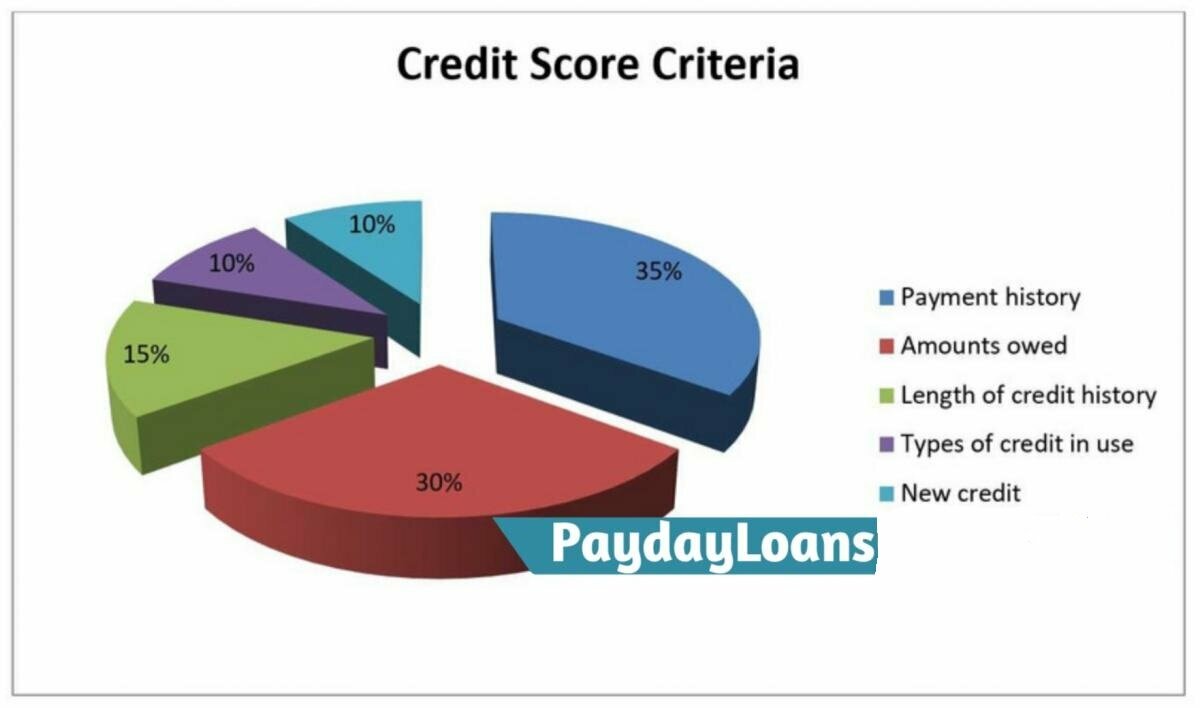

The credit score used most often is called the FICO score, named after the Fair Isaacs Corporation. It’s used by 90% of lending organizations. The main criteria that they take into account are shown in the diagram below:

According to these five factors, mentioned in the table, your credit score is measured, and you are categorized as a good risk or a bad risk.

You are considered risky if: |

You are considered safe if: |

|

|

Types of Credit Score.

The FICO score ranges between 300 and 850. The higher the score, the better. According to this number, consumers can be divided into several groups.

Credit title |

Poor |

Fair |

Good |

Very good |

Exceptional |

Credit score |

300-579 | 580-669 | 670-739 | 740-799 | 800+ |

What does it mean? |

You may be rejected. Or you may need to pay a fee or a deposit. | To get approved may be rather difficult, and the rates are likely to be higher. | You are an “acceptable” borrower. | You may get better interest rates from lenders. | You will be easily approved for a loan. |

27% of people have a very good score while only 2% - poor. The highest average score is in Wisconsin, the lowest in Mississippi. Still any US resident with financial difficulties can apply and get approved for a loan. Those with very good or even exceptional scores may qualify for any type, amount and lower-rate loans, while the others can get a payday, personal or installment loan.

How can I take a payday loan if I have a poor credit score?

If your credit history is far from perfect, it doesn’t mean you can’t borrow the money you need. There are still several options. You may turn to a credit union, family, friends, peer-to-peer lending platforms or use our online service.

We offer payday, personal and installment loans from more than 300 direct lenders with reasonable rates, subject to conditions, including your credit score. Our partners look at your overall situation, and not only your credit score. Payday loans in the amount $100-$1,000 are available even for those with fair or poor credit. You’ll get up to $1,000 cash deposited into your account within 24 hours. Just fill out a simple application form online. And if you meet the lenders’ basic requirements (18 years of age, being a resident of the USA, having a valid bank account and a permanent job with stable income) you’ll be approved for a loan.

Installment and personal loans are also available for borrowers with bad credit. Your score can influence the amount you are approved for, and the interest rate the lender will offer you. The maximum sum for an installment cash advance is $5,000, and for a personal loan, $15,000. In any case, you need no collateral, no guarantor, no paperwork. The money is yours without any additional paperwork, driving, or waiting in lines. No matter whether your credit score is 400, 550, or 600, let us help you to find a suitable reliable lender.

How can I improve my credit score?

Having poor credit is not a verdict. You can make things better, and life easier. All you need is knowledge. And we can provide you with the necessary information you need. Here are some tips on how to improve your credit score:

- Try not to default on your loans; and pay your bills on time.

- Be attentive to your credit card balance. It will influence your score more than other types of credit.

- Do not exceed your credit card limit. Preferably, use less than 10% of it. If your available credit is $15,000, try not to keep a balance above $1,500.

- Don’t have debt in too many different accounts.Try to consolidate your debt onto one credit card.

- Take care of your credit report. You may get it free, once a year; online, at annualcreditreport.com or by phone 1-877-322-8228. Double-check all the data and numbers. Let the lenders know about any issues or mistakes.

If you follow this advice, you’ll be able to control your credit score. It will lead to its’ improvement, which means you’ll be able to borrow more money at lower rates.